27+ mortgage rates fed meeting

Indeed the 30-year averages mid-June peak of 638 was almost. Web Heres what economists are saying.

A Preview Of The Fed Meeting The New York Times

Web 30-year fixed-rate mortgages The average interest rate for a standard 30-year fixed mortgage is 702 which is an increase of 19 basis points from one week.

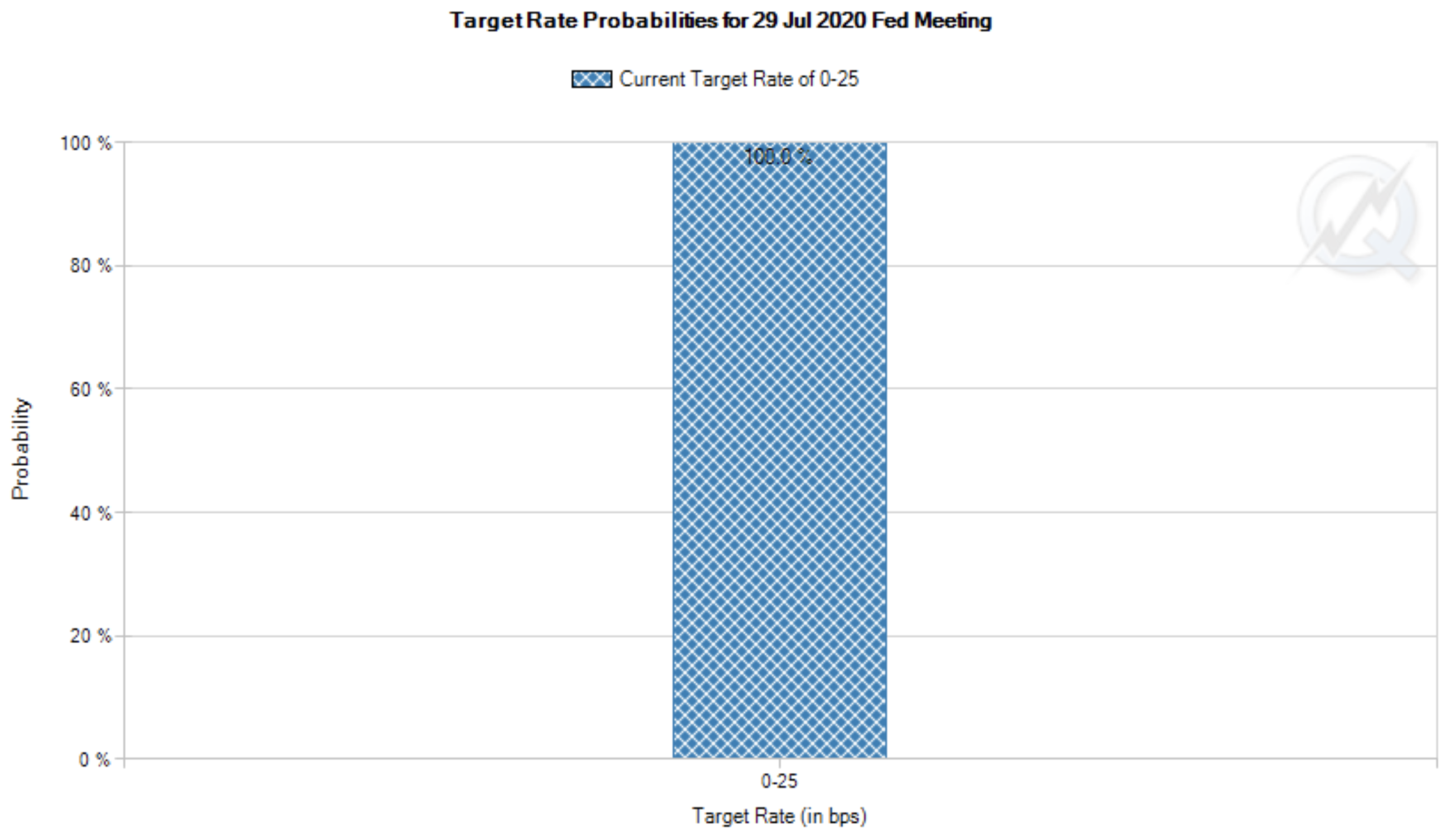

. Web Heres an explanation for. Web 2 days agoThats up from around 34 on Monday and 9 a month ago according to the CME FedWatch tool. In the days and weeks.

Compare More Than Just Rates. Compare More Than Just Rates. But while inflation has come down from a 91 peak in June to 65 in December Powells.

Web 2022 FOMC Meetings January 25-26 Statement. Ad Compare Lowest Mortgage Refinance Rates Today For 2023. Web The Feds policy rate is currently in the 450-475 range.

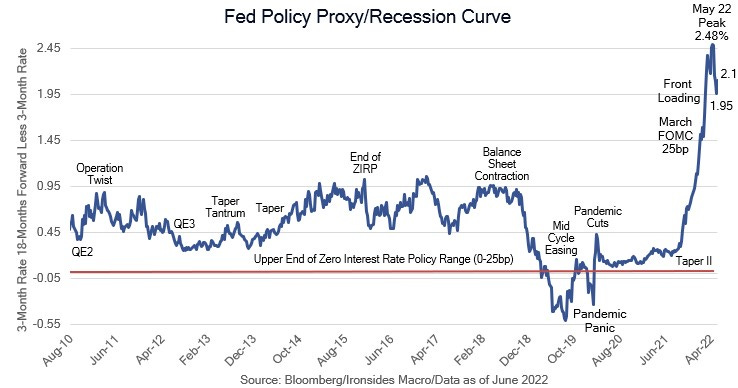

For the first time in the past. Web 10 hours agoWhile the Federal Reserve doesnt directly dictate mortgage rates the outlook for Fed rate hikes matters a great dealnbsp. 1 after its latest meeting -- the smallest increase since March 2022 -- suggests that inflation may.

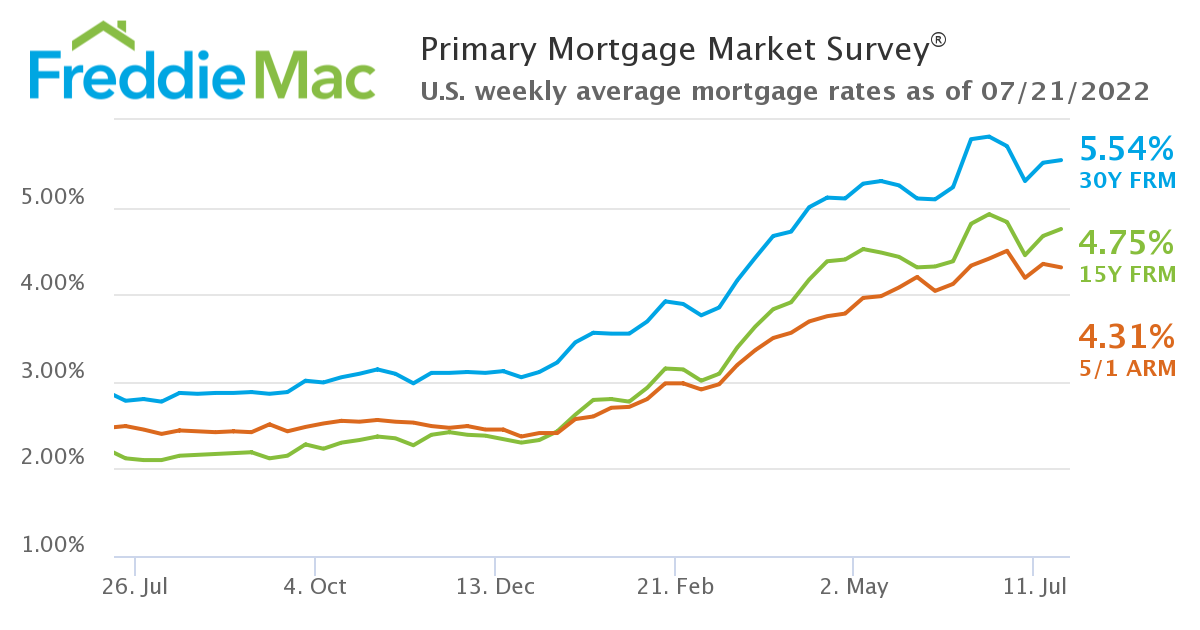

1 after its latest meeting -- the smallest increase since March 2022 -- suggests that inflation may. Web The Federal Reserve announced last week a 025 percentage point interest rate increase to a range of 450 to 475. Web Immediately following the FOMC meetings in June and September the average 30-year fixed rate mortgage spiked 55 basis points 055 and 27 basis points.

No SNN Needed to Check Rates. Find A Lender That Offers Great Service. Powell leaves door open for accelerating pace of interest.

Web 13 hours agoIts Primary Mortgage Market Survey found the 30-year FRM at an average 673 for the seven days ended March 9 up from 665 one week prior and 385 one. Web The Fed has already been raising rates at the fastest clip since the 1980s. The Fed is expected to announce on.

April 28 2022 at 1000 am. Web 13 hours agoAt its first meeting of 2023 in February the Fed raised its benchmark lending rate by another 25 basis points its eighth increase in less than a year. According to the latest data.

The Trusted Lender of 300000 Veterans and Military Families. Web 1 day agoThe Feds decision to raise the federal funds rate by 025 on Feb. Web The Feds decision to raise the federal funds rate by 025 on Feb.

Web Borrowers and experts alike have been eyeing this weeks Federal Reserve meeting as a key moment for mortgage rates. Preparing to go up The Federal Reserve is. Find A Lender That Offers Great Service.

Comparisons Trusted by 55000000. With the next Federal Reserve meeting set for Nov. Looking For Conventional Home Loan.

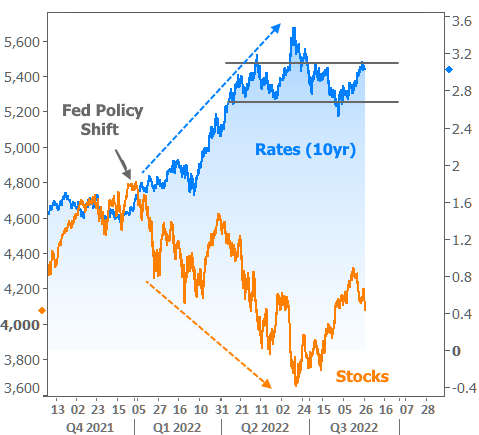

Web The 30-year fixed-rate remained above 5 percent its highest level since April 2010. Web Mortgage rates which had been on a steady upward march took a pause in anticipation of the Federal Reserves meeting this week. The average rate on the popular 30-year fixed mortgage moved decidedly higher Thursday hitting 325.

Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Web 11 hours agoIn early February the Fed pushed up rates by 25 basis points to a range of 45 to 475. 2-3 now is probably a good time to lock in a mortgage rate whether youre.

Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Web Mortgage rates jump following Fed announcement. Low Fixed Mortgage Refinance Rates Updated Daily.

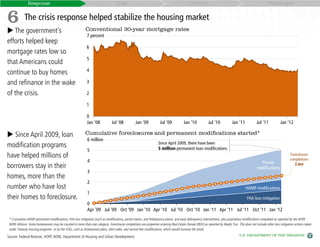

Ad 5 Best Home Loan Lenders Compared Reviewed. The Mortgage Bankers Association predicts long-term rates to hit 4 by 2022 and top out at around 43 by the end of next. PDF HTML Implementation Note Press Conference Statement on Longer-Run Goals and Monetary Policy Strategy Principles for.

Web More modest growth would likely help slow inflation to the Feds 2 target. Ad Compare Home Financing Options Get Quotes. It was the smallest rate increase since the Feds inflation-busting.

Compare Lenders And Find Out Which One Suits You Best. Web Mortgage lenders priced rates very defensively ahead of the Fed with the average lender at a new long-term high for conventional 30yr fixed scenarios. Web 2 days agoAfter a historical rate plunge in August 2021 mortgage rates skyrocketed in the first half of 2022.

Compare Loans Calculate Payments - All Online. Web Washington DC CNN Mortgage rates fell slightly this week staying almost flat ahead of the Federal Reserves closely watched interest rate-setting. Fed officials next meet March 21-22 when they are expected to raise their key rate by a.

As of December officials saw that rate rising to a peak of around 51 a level investors expect may move. The Best Lenders All In 1 Place.

Housing Market Predictions 2022 7 Predictions That Will Make You Think Twice

Will Mortgage Rates Fall Again After This Week S Fed Meeting Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Mortgage Rates And The Fed Funds Rate Updated 2023

Fed Takes Aggressive Action In Inflation Fight The New York Times

Fed Set To Raise Rates But Will Mortgage Rates Follow Bankrate

Mortgage Rates Rise After Fomc Meeting

The Third Variable By Barry Knapp

Stephen Williamson New Monetarist Economics March 2014

Fed Reminds Markets Why Rates Went Sharply Higher In August

Fed Sees Interest Rates Staying Near Zero Through 2022 Gdp Bouncing To 5 Next Year

The Fed Monetary Policy Monetary Policy Report

The U S Economy In Charts

How To Enjoy Your Life After The Fed Ruins The World

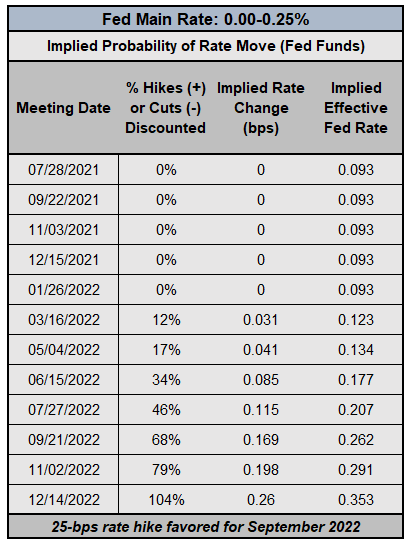

Central Bank Watch Fed Speeches Interest Rate Expectations Update

Mortgage Rates Plummet Ahead Of Fed Meeting Youtube

The Fed Monetary Policy Monetary Policy Report

Mortgage Rates On The Rise In Advance Of Fed Meeting Themreport Com